On November 2, the House released its much-anticipated tax bill (H.R. 1 ) called the Tax Cuts and Jobs Act. The measure has many moving parts and it’s … Read more about What the Proposed Tax Bill Means to Small Business Owners

Work Opportunity Credit for Hiring Veterans: 10 Things to Know

Veterans Day, which originally was fixed to commemorate the Armistice for World War I but later became a day to honor veterans of all wars, is … Read more about Work Opportunity Credit for Hiring Veterans: 10 Things to Know

The Question of Boredom Isn’t Boring

A recent survey from OfficeTeam found some astounding statistics regarding boredom in the workplace: Professionals said they were bored on … Read more about The Question of Boredom Isn’t Boring

Getting Ready for Your 2018 Retirement Plan: Changes Ahead

Whether you already have a qualified retirement plan in place or are thinking of starting one for 2018, now is a good time to familiarize yourself … Read more about Getting Ready for Your 2018 Retirement Plan: Changes Ahead

Opioid Crisis and Small Business

It seems no family, no community, and no business is untouched by the opioid crisis. HHS reports that in 2015 there were more than 70,000 deaths and … Read more about Opioid Crisis and Small Business

Tax Deductions for Cybersecurity

Cybersecurity describes measures you take to protect your computer and information from unauthorized access. Concerns about cybersecurity are … Read more about Tax Deductions for Cybersecurity

Tax Developments for Farmers

According to the U.S. Department of Agriculture, there are over 2 million farms in the U.S. The vast majority are small farms, which means they’re … Read more about Tax Developments for Farmers

Your Obligation to Employees during Emergency Shutdowns

The hurricanes got me thinking … do employers have to pay their staff during the period that a company is shut down? Hurricanes aren’t the only … Read more about Your Obligation to Employees during Emergency Shutdowns

Get Small Business Health Insurance Fast

This is a sponsored post by UnitedHealthcare. All thoughts and opinions are my own. Buying health coverage is increasingly important in this tight … Read more about Get Small Business Health Insurance Fast

Reimbursing Employees for Business Travel

If your employees go out of town on company business, likely the company is picking up the tab. From a tax perspective, there are certain ways to do … Read more about Reimbursing Employees for Business Travel

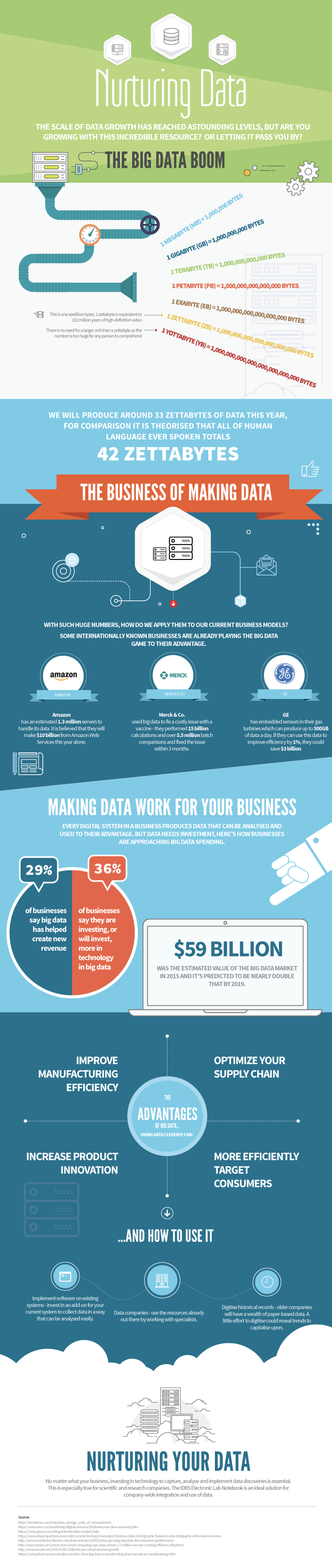

Big Data and Small Business

According to Dictionary.com, big data is consists of “billions or trillions of records that are so vast and complex that they require new and powerful … Read more about Big Data and Small Business

Sharing Good Ideas

When I started Big Ideas for Small Business, Inc. more than 17 years ago, it was for the purpose of publishing information for small business owners. … Read more about Sharing Good Ideas

Handling Plan Loans

Shakespeare said in Hamlet “neither a borrower nor a lender be,” but he didn’t know about 401(k) plans and their ability to offer easy terms for … Read more about Handling Plan Loans

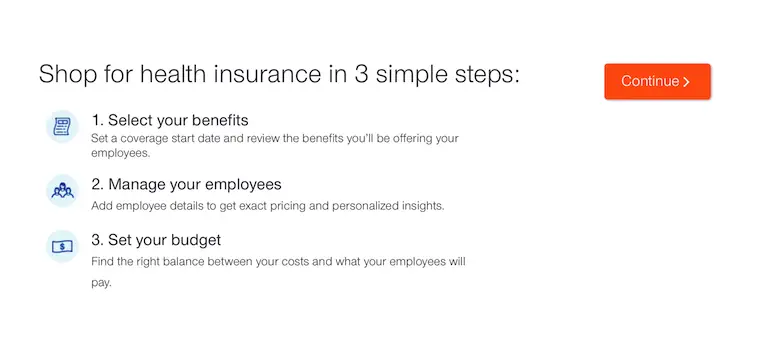

New Way to Shop for Health Care Coverage

This is a sponsored post by UnitedHealthcare. All thoughts and opinions are my own. The status of the Affordable Care Act is up in the air and … Read more about New Way to Shop for Health Care Coverage

Payment Card Security: How Do You Measure Up?

Equifax recently experienced a data breach that impacted an estimated 143 million people. If it can happen to Equifax, it can happen to any business. … Read more about Payment Card Security: How Do You Measure Up?