Small business owners want a safe and supportive work environment for their staff. One disrupter is domestic abuse, the effects of which do not stop … Read more about What Small Business Owners Should Know About Domestic Abuse

Surprised by Tax Penalties? How to Get Relief

The IRS has a slew of penalties that may be imposed for doing something wrong, doing something late, or failing to do what you should have done: … Read more about Surprised by Tax Penalties? How to Get Relief

Good Reasons to Add Professionals to Grow Your Business

Small businesses don’t have in-house departments for payroll, legal, accounting, IT, marketing, etc. Many small business owners try to DIY for all of … Read more about Good Reasons to Add Professionals to Grow Your Business

See How to Better Help Employees with Childcare

Childcare benefits can have a positive impact on recruitment, retention, and productivity—all key concerns for employers. According to a survey by … Read more about See How to Better Help Employees with Childcare

Secrets of Business Credit Cards Benefits

Business owners know that they need to have credit cards exclusively for business use and that they should not charge business expenses to their … Read more about Secrets of Business Credit Cards Benefits

Know Your Risks and Mitigation Strategies

I think small business owners are the bravest people. They face a myriad of risks, any one of which can undermine the viability of their businesses. … Read more about Know Your Risks and Mitigation Strategies

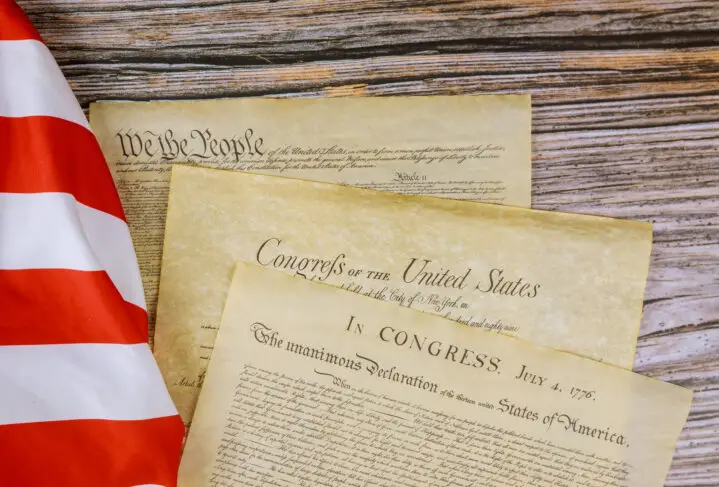

Entrepreneurs Who Made the Revolution

It’s been 248 years since a group of men in Philadelphia signed the Declaration of Independence and started a revolution. The document was adopted on … Read more about Entrepreneurs Who Made the Revolution

Mid-Year Tax Planning Musts for Your Business

Tax planning may not be your favorite activity, but it’s one that can put money in your pocket. The decisions you make now and execute before the end … Read more about Mid-Year Tax Planning Musts for Your Business

Who, What, Where, When, Why, and How to Use Social Media to Grow Your Business

A few years ago, Adobe said content democratization is changing the business landscape, and this can be a big boost to small businesses. In the past, … Read more about Who, What, Where, When, Why, and How to Use Social Media to Grow Your Business

What Payment Methods Do You Use for Your Obligations?

You have to pay the rent, make payroll, deposit taxes, pay vendors, and more. You want to do this in the most efficient way, meaning you want to … Read more about What Payment Methods Do You Use for Your Obligations?

What Type of Payments to Accept: From Barter to Biometrics

When you hear “show me the money,” what does it mean? Money might conjure up a vision of piles of U.S. dollar bills or bags of coins, but today money … Read more about What Type of Payments to Accept: From Barter to Biometrics

5 Great Tax Shortcuts to Save You Time and Effort

Taxes and the related chores—recordkeeping, filing, and paying—are perhaps the least favorite things for a business owner to do. Still, they’re … Read more about 5 Great Tax Shortcuts to Save You Time and Effort

Are You Lucky? This Matters to Business Success

There are basically 4 factors that are necessary for business success: a good idea, sufficient capital to start up, hard work, and luck. Which factor … Read more about Are You Lucky? This Matters to Business Success

Business Lessons from My Dad

Father’s Day is a few days away and this day reminds me of the business lessons I learned from my dad at the dinner table each day while I was growing … Read more about Business Lessons from My Dad

Multiple Businesses with Common Ownership: Tax Rules You Need to Know

Entrepreneurs may not be content with owning a single business. They may have two or more companies going at the same time. They may own some or all … Read more about Multiple Businesses with Common Ownership: Tax Rules You Need to Know