That’s the admonition to those with or considering a sideline activity if you want good tax results -- "Your sideline business better be for … Read more about Your Sideline Business Better Be for Profit

3 Big Reasons to Rethink Retirement Plans

Qualified retirement plans aren’t just for large corporations. There are a number of compelling reasons for small businesses to consider adopting a … Read more about 3 Big Reasons to Rethink Retirement Plans

10 Smart Things You Can Do with an Extra $10Gs

If your business nets $50,000 and you qualify for the new 20% business income deduction for owners of pass-through entities, you’ll save $10,000 in … Read more about 10 Smart Things You Can Do with an Extra $10Gs

Do’s and Don’ts for the Home Office Deduction

According to the SBA, about 50% of all businesses in the U.S. are home-based. More specifically, 60.1% of all businesses without paid employees are … Read more about Do’s and Don’ts for the Home Office Deduction

What the Supreme Court’s Decision on Taxing Internet-based Sales Means to You

On June 21, 2018, the U.S. Supreme Court, in a 5-4 decision, changed a position it had held for decades. Back in the early 90’s, the Court, in a case … Read more about What the Supreme Court’s Decision on Taxing Internet-based Sales Means to You

Helping Employees Pay Business Expenses

If your employees pay for some business expenses, they’re going to be in for a big surprise when they file their 2018 returns in 2019. They won’t be … Read more about Helping Employees Pay Business Expenses

Partnerships and LLCs from a Tax Perspective

A partnership is not a taxpaying entity (unless there is an adjustment from an audit under the Bipartisan Budget Act audit rules), but it files an … Read more about Partnerships and LLCs from a Tax Perspective

Take Credit for Giving Paid Medical Leave

Federal law doesn’t make you pay employees who take family and medical leave. This is so even if you are required by the federal Family and Medical … Read more about Take Credit for Giving Paid Medical Leave

5 Things to Do for Your Business (and Yourself) with a Tax Refund

Most owners of small businesses have pass-through entities (e.g., sole proprietorships, S corporations, partnerships, LLCs) and report their share of … Read more about 5 Things to Do for Your Business (and Yourself) with a Tax Refund

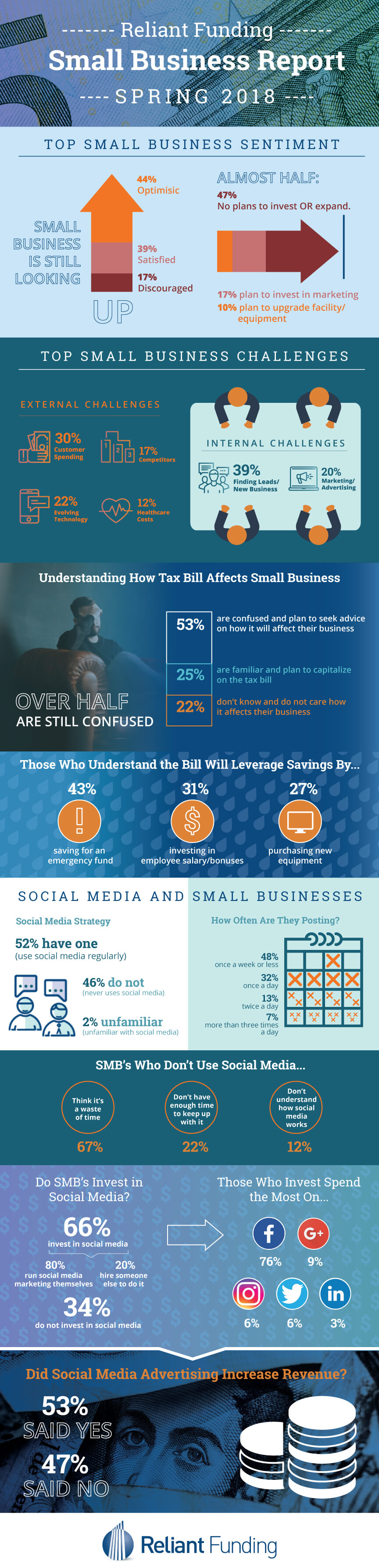

Are You Confused by the Tax Cuts and Jobs Act?

If so, you’re not alone. According to a survey by Reliant Funding, 53% of small businesses are confused by the Tax Cuts and Jobs Act and plan to … Read more about Are You Confused by the Tax Cuts and Jobs Act?

How the Tax Cuts and Jobs Act Is Changing How We Do Business

Following enactment of the Tax Cuts and Jobs Act, there’s been much public discussion about tax rate changes, the 20%qualified business deduction for … Read more about How the Tax Cuts and Jobs Act Is Changing How We Do Business

Upgrade Your Equipment Now

Spring is a great time to clean house when it comes to your office equipment. Ditch old items in favor of new ones that will perform more efficiently … Read more about Upgrade Your Equipment Now

New Tough Tax Rules for Business Losses

Okay, you’re not in business to lose money but it can happen from time to time. The tax law has new rules in store for you when it comes to writing … Read more about New Tough Tax Rules for Business Losses

5 Tax Preparation Tips

Yes, it’s that time again when you must file a tax return for your business and yourself. Whether you do this on your own or rely on a tax … Read more about 5 Tax Preparation Tips

What Should You Pay Yourself?

As a small business owner, you run a business to create something, but you also need to support yourself. So deciding what to pay yourself is a … Read more about What Should You Pay Yourself?