According to Verizon’s 2018 Data Breach Investigations Report (11th Edition), there were over 53,000 incidents and 2,216 confirmed data breaches. Of … Read more about Data Breaches of Small Businesses

5 Things to Do for Your Business (and Yourself) with a Tax Refund

Most owners of small businesses have pass-through entities (e.g., sole proprietorships, S corporations, partnerships, LLCs) and report their share of … Read more about 5 Things to Do for Your Business (and Yourself) with a Tax Refund

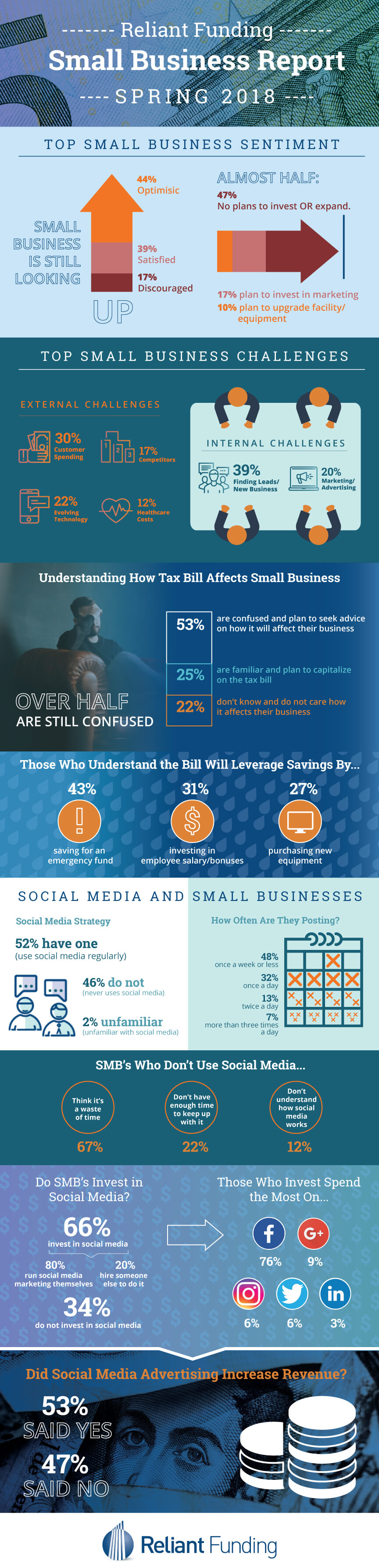

Are You Confused by the Tax Cuts and Jobs Act?

If so, you’re not alone. According to a survey by Reliant Funding, 53% of small businesses are confused by the Tax Cuts and Jobs Act and plan to … Read more about Are You Confused by the Tax Cuts and Jobs Act?

Disruptive Thinking for Your Business

Winston Churchill said, “Kites rise highest against the wind—not with it.” For businesses to succeed in a big way, owners need to use disruptive … Read more about Disruptive Thinking for Your Business

What’s Your Privacy Policy?

Facebook has recently come under government scrutiny with lawmakers and the Federal Trade Commission demanding that the company explain its privacy … Read more about What’s Your Privacy Policy?

Accountable Plans Revisited

Accountable plans are an IRS-approved way to reimburse employees for various business expenses in a tax-advantaged manner. Everyone wins … employees … Read more about Accountable Plans Revisited

5 Things to Know About Business Credit Cards

It’s probably no surprise to you that credit cards play an important role in financing for small businesses. During the Great Recession, they were … Read more about 5 Things to Know About Business Credit Cards

What to Do about Social Media Cyber Vandalism

Social media cyber vandalism occurs when someone takes control of your social media platforms, such as Facebook or Twitter and uses it to misdirect … Read more about What to Do about Social Media Cyber Vandalism

How the Tax Cuts and Jobs Act Is Changing How We Do Business

Following enactment of the Tax Cuts and Jobs Act, there’s been much public discussion about tax rate changes, the 20%qualified business deduction for … Read more about How the Tax Cuts and Jobs Act Is Changing How We Do Business

Upgrade Your Equipment Now

Spring is a great time to clean house when it comes to your office equipment. Ditch old items in favor of new ones that will perform more efficiently … Read more about Upgrade Your Equipment Now

Spring Cleaning for Your Business

Now that Spring has arrived, it’s a good time to clean house. This action can make you more efficient and save you money as well. Spring cleaning for … Read more about Spring Cleaning for Your Business

The State of Women-Owned Businesses

March is Women’s History Month and a good time to reflect on how women are doing in business. According to American Express’ 2017 State of Women-Owned … Read more about The State of Women-Owned Businesses

New Tough Tax Rules for Business Losses

Okay, you’re not in business to lose money but it can happen from time to time. The tax law has new rules in store for you when it comes to writing … Read more about New Tough Tax Rules for Business Losses

Perks Matter

Perks are short for perquisites, which Merriam-Webster defines as “a privilege, gain, or profit incidental to regular salary or wages.” According … Read more about Perks Matter

What to Do with Your Company’s Money

“Don’t tell me where your priorities are. Show me where you spend your money and I’ll tell you what they are.” James W. Frick (VP at the University of … Read more about What to Do with Your Company’s Money