I’m proud to say it’s the 25th year of the original publication, and it’s all new for 2018 returns and year-round tax planning. The new edition, named … Read more about J.K. Lasser’s Small Business Taxes 2019

10 Things to Know about the QBI Deduction

The Tax Cuts and Jobs Act created a new personal deduction, called the qualified business income (QBI) deduction, for owners of pass-through entities … Read more about 10 Things to Know about the QBI Deduction

Your 2019 Budget

Now that we’re in the fourth quarter of 2018, it’s time to nail down your budget for the coming year. Be sure to consider the following … Read more about Your 2019 Budget

Deducting Business Meals

The Tax Cuts and Jobs Act eliminated any deduction for entertainment costs, so taking a customer to a ballgame or an associate to the theater is not … Read more about Deducting Business Meals

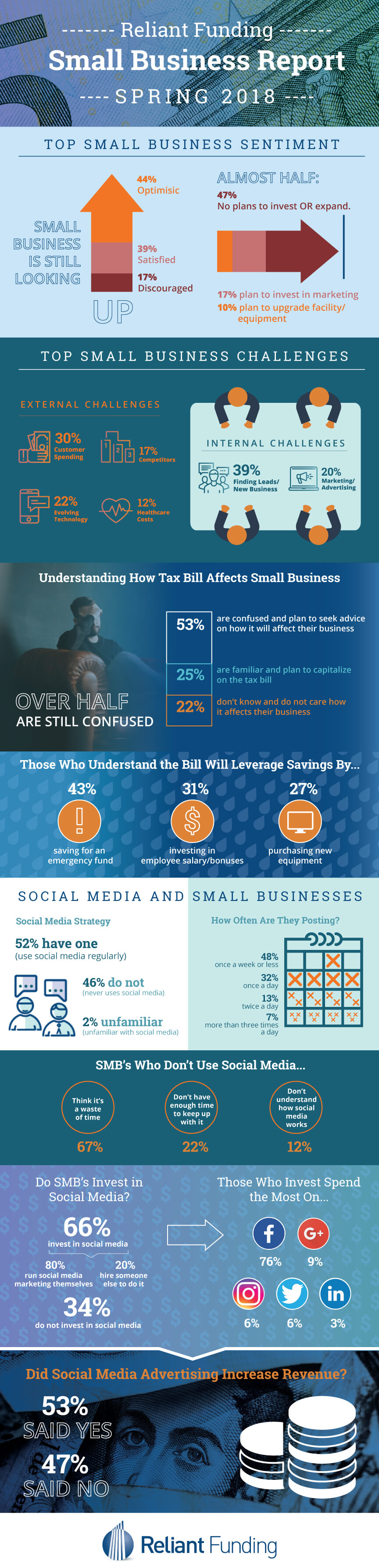

Are You Confused by the Tax Cuts and Jobs Act?

If so, you’re not alone. According to a survey by Reliant Funding, 53% of small businesses are confused by the Tax Cuts and Jobs Act and plan to … Read more about Are You Confused by the Tax Cuts and Jobs Act?

How the Tax Cuts and Jobs Act Is Changing How We Do Business

Following enactment of the Tax Cuts and Jobs Act, there’s been much public discussion about tax rate changes, the 20%qualified business deduction for … Read more about How the Tax Cuts and Jobs Act Is Changing How We Do Business

What the Proposed Tax Bill Means to Small Business Owners

On November 2, the House released its much-anticipated tax bill (H.R. 1 ) called the Tax Cuts and Jobs Act. The measure has many moving parts and it’s … Read more about What the Proposed Tax Bill Means to Small Business Owners