The last quarter of the year is packed with activities for a small business owner, including year-end planning and budgeting for next year.

One more task is deciding on health coverage: selecting the insurer to use and setting the budget to cover costs.

As a small business owner, know your responsibilities and your options, some of which may be new.

Health coverage for small businesses

If you have fewer than 50 full-time and full-time equivalent employees, the Affordable Care Act (ACA) does not mandate that you provide your staff with health coverage. Nonetheless, most small business owners I know want to do this because they care about their workers. They also recognize that in a tightening job market, they have to offer this fringe benefit to stay competitive.

Caution: It had been a long-standing practice of some small businesses to reimburse the cost of coverage that employees obtain on their own rather than having a company plan. Such reimbursements violate ACA and can result in a $100 per employee per day penalty. Pending legislation would change this result, but the measure has not yet been enacted.

Shopping for coverage

Small business owners who want to claim the credit for small employer health insurance premiums on their income tax returns must buy coverage through a SHOP, which is the government Marketplace for small businesses. Obtaining coverage through the SHOP may not be the best option for your company because the coverage offerings are limited, and even if coverage is purchased here, you may not qualify for the tax credit (e.g., the credit cannot be taken if you’ve already used it in two consecutive years).

New online portal

UnitedHealthcare has created Online Shopping Experience, which is a one-of-a-kind way for small businesses to buy coverage. This unique insurance buying experience is limited to companies with 2-50 employees. Rather than selecting a single plan for the company, this new Online Shopping Experience will soon enable a small business to offer employees options for coverage based on specific health care needs and lifestyle (this feature is expected to be available in December).

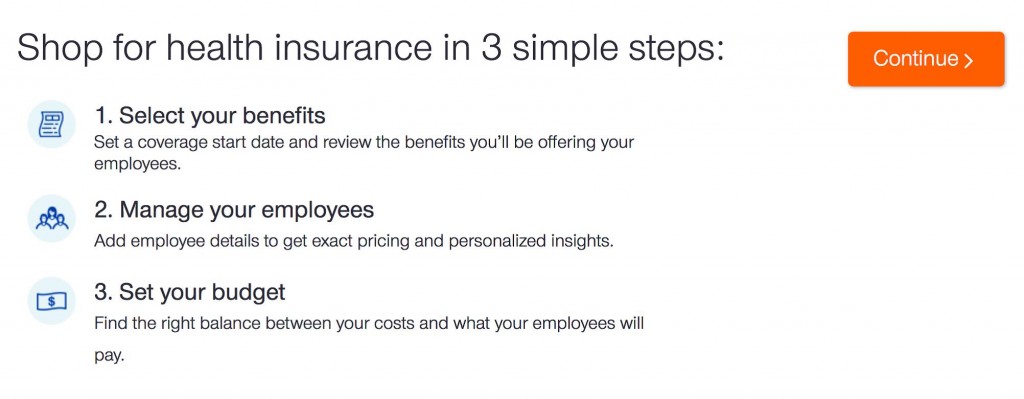

This Online Shopping Experience allows small businesses to:

- Comparison shop multiple plans based on location and the number of employees. In some locations, there are as many as 27 plans to choose from. These plans include Health Savings Accounts (along with a high-deductible health plan), HMOs, PPOs, and more.

- Get customized quotes and real pricing/rates based on each employee’s age and family type. You decide how much will be spent on each employee and then the employees choose the plan that works for them. The employee pays the difference between your monthly contribution and the cost of the plan that the employee selects.

- Purchase online plans. You can easily manage health coverage, adding and deleting employees as needed.

Through an online account, the company can easily view the total benefits package, including costs, plan choices, and how premiums breakout for employees and the employer. This information is vital for employers with 50 or more full-time/full-time equivalent employees because they are required to file an annual information return, IRS Form 1095-C; the information that you view online is used to complete the form.

The portal is a do-it-yourself process for small businesses. However, throughout the process there are helpful links and a “Contact Coverage Advisor” button to get customized assistance.

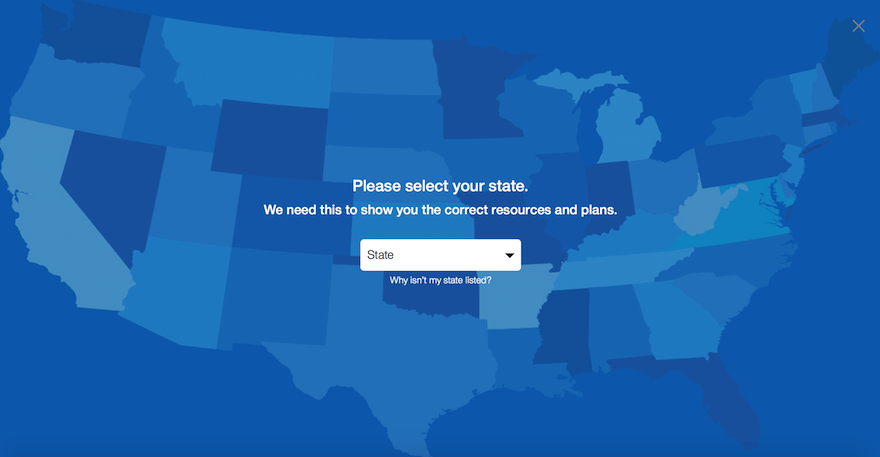

Thus far, Online Shopping Experience is available in 15 states: Arizona, California, Florida, Illinois, Indiana, Kentucky, Maryland, Michigan, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and Wisconsin.

It will be available in more or states in 2017.

Conclusion

Anne M. Mulcahy, former CEO of Xerox, said “Employees who believe that management is concerned about them as a whole person – not just an employee – are more productive, more satisfied, more fulfilled. Satisfied employees mean satisfied customers, which leads to profitability.”

Offering health coverage options is one big way that you as a small business owner can show your concern for your staff. Doing this digitally makes the process easy for you and your employees.

This post was created in partnership with UnitedHealthcare. All opinions expressed in the post are my own and not those of UnitedHealthcare.