This is a sponsored post by UnitedHealthcare. All thoughts and opinions are my own.

Buying health coverage is increasingly important in this tight job market so you can retain your current workers and attract new ones, as I’ve mentioned in a previous post.

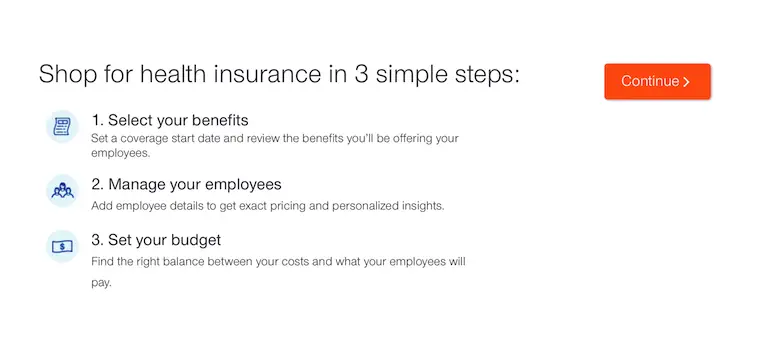

The process may seem like an overwhelming task and a big distraction from running your business. It’s not so. You can make highly informed decisions about coverage choices in less than 20 minutes. Let me explain how.

Getting started

There’s a simple online process to get a quote on health coverage. All you need to do is provide basic information about your company’s location, your employees, and your budget.

Before doing this, create an online account with your self-selected user name and password so you can review the quote, make changes in information, and revise the quote, as well as share the information.

Creating an online account also allows you to input your information in stages, so if business calls you away from this task, you can pick it up at your convenience.

Company information

Enter information about your company: your ZIP code, the number of employees, and when you want coverage to begin (e.g., January 1, 2018).

Employee details

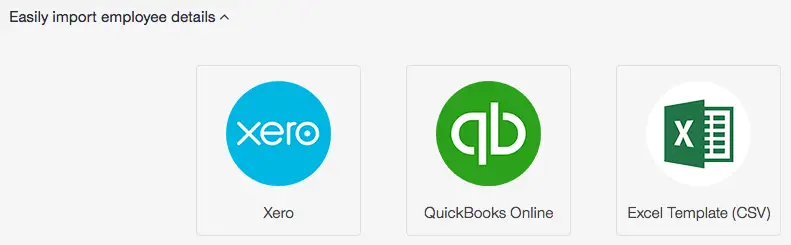

Provide vital information about your employees: their age, gender, ZIP code, and whether they are adding spouses and/or children. You can enter this information automatically by importing it from Quickbooks, Xero, or certain other software, or you can key it in manually.

Budget

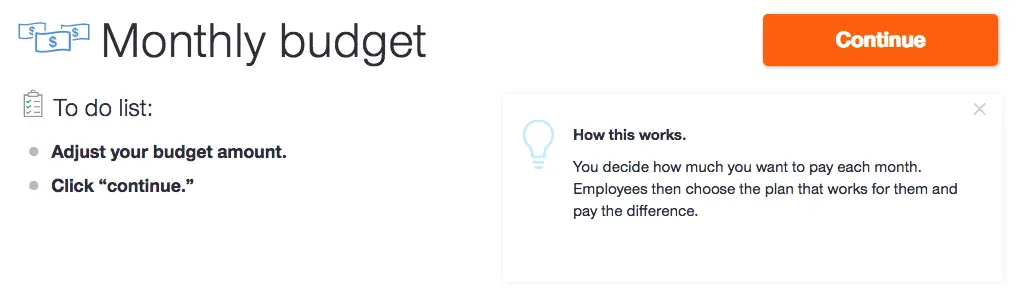

Decide how much you can afford to pay monthly toward the cost of employee coverage. Your cost is fixed, but the employee’s share varies with the plan chosen (there’s an interactive slider tool that displays this information). According to the 2017 Kaiser Foundation Health Benefits Survey, employees in small firms pay on average 39% of their health coverage premiums.

Keep in mind that your budget does not limit plan availability; it merely affects what employees will pay for their coverage.

Selecting medical plans

You, the employer, choose the plan or plans offered to employees. By offering a variety of plans, you allow employees to select the one that works best for them. You aren’t limited in the menu of plans offered to employees. You have the option of exploring common employee profiles (e.g., young and healthy, family focused, professional and secure) to better understand which plan or plans to offer.

The plans run the gamut from high-deductible (low premium) plans, to mid-deductible, and low-deductible (high premium) plans. These plans reflect the range of metal plans: platinum, gold, silver, and bronze. The high-deductible health plan can be combined with a Health Savings Account (HSA) to cover an employee’s out-of-pocket costs (not including the cost of coverage).

If you offer 6 or more plans, this lets employees use the interactive Employee Fit Finder tool to narrow their plan choice. The tool asks them about their family and lifestyle to point them in the right direction.

Completing your quote

Once you decide on the coverage you want, just confirm the benefits package and billing information, and then check out.

At any point in the process, you can work with a coverage advisor to answer questions and make sure you’ve set things up correctly. This advisor can also help with adding specialty benefits, such as vision and dental coverage. Start now at SmallBusiness.uhc.com.

The views expressed do not reflect those of UnitedHealthcare nor its affiliates. They are my personal opinions. While UnitedHealthcare has made every attempt to ensure accuracy, the information contained in these blogs may change and UnitedHealthcare assumes no responsibility for errors, omissions, contrary interpretations of the subject matter or information herein or for any losses, injuries, or damages arising from its display or use. These blogs may connect to other websites maintained by third parties over whom UnitedHealthcare has no control. UnitedHealthcare makes no representations as to accuracy, completeness, suitability, or validity of any information contained in those linked blogs or third party websites. Blogs are for general informational purposes only and not intended to be medical advice or a substitute for professional health care.