The law requires businesses to keep books and records of income and expenses. And to take deductions and other tax breaks, you need to meet certain … Read more about Small Business Tax Recordkeeping Made Easy: 7 Proven Tips

What Are Peanut Butter Pay Raises? Plus More Ways to Reward Employees

You want to reward employees, and the main way to do this is with pay increases. This can be done in various ways. In addition to or in lieu of pay … Read more about What Are Peanut Butter Pay Raises? Plus More Ways to Reward Employees

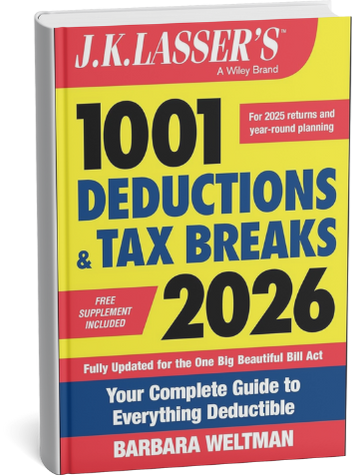

Supplement to J. K. Lasser’s 1001 Deductions and Tax Breaks 2026

By Barbara Weltman THIS SUPPLEMENT REFLECTS CHANGES THROUGH FEBRUARY 1, 2026. This year’s book, J.K. Lasser’s 1001 Deductions and Tax Breaks 2026, … Read more about Supplement to J. K. Lasser’s 1001 Deductions and Tax Breaks 2026

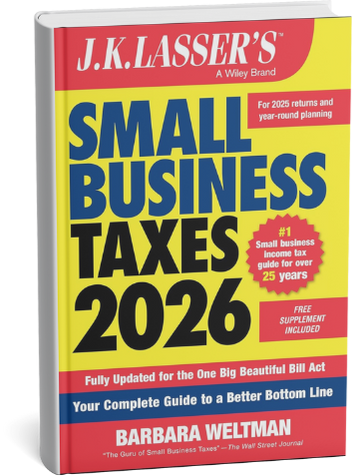

Supplement to J.K. Lasser’s Small Business Taxes 2026

By Barbara Weltman THIS SUPPLEMENT REFLECTS CHANGES THROUGH FEBRUARY 1, 2026. This year’s book, J.K. Lasser’s Small Business Taxes 2026, covers the … Read more about Supplement to J.K. Lasser’s Small Business Taxes 2026

Other Important Things to Know Before Starting a Business

In the first 11 months of 2025, more than 5.1 million new business applications were filed. If you’re looking to become a statistic—a new … Read more about Other Important Things to Know Before Starting a Business

Got a Government Notice? A Practical Guide for Business Owners

It can happen. You receive an official-looking letter from a government agency or a court that’s filled with a lot of legalese. What do you do? The … Read more about Got a Government Notice? A Practical Guide for Business Owners

Simple Time Management Solutions for Small Business Owners

You know the cliches: “time is money,” “work smarter not harder,” “one thing you can’t recycle is wasted time.” Most small business owners work long … Read more about Simple Time Management Solutions for Small Business Owners

The Tax Implications of Writing Off Bad Debts

A debt is something that is owed or due. In a business context, a debt can take several forms, from accounts receivable (A/R) to the “buy now pay … Read more about The Tax Implications of Writing Off Bad Debts

Sustainability: 4 Important Reasons Why and How

Sustainability is defined as the ability to be sustained, supported, upheld, or confirmed. In a business context, there are a number of good reasons … Read more about Sustainability: 4 Important Reasons Why and How

Complete 2026 IRS Tax Calendar for Small Business Owners

As a business owner, there are various tax filing and payment responsibilities. Mark your calendar for actions you need to take this year, so you … Read more about Complete 2026 IRS Tax Calendar for Small Business Owners

Family and Medical Leave Essentials for Small Businesses

Do you have to offer family and medical leave to your employees? Does it have to be paid? Do you get a tax break for this? These and other questions … Read more about Family and Medical Leave Essentials for Small Businesses

What AI Really Means for Your Business in 2026

Artificial intelligence—AI—is a topic that continues to dominate the news. Last year the U.S. Chamber of Commerce found that the majority of small … Read more about What AI Really Means for Your Business in 2026

Do You Know How to Manage W-4s for 2026?

Form W-4 is an IRS form used by employees to tell employers certain information used to figure federal income tax withholding. If an employee fails to … Read more about Do You Know How to Manage W-4s for 2026?

A Look Back: What’s Changed for Small Businesses in 2025?

Many things happened in 2025—locally, nationally, and internationally. Some of these changes directly impact small businesses. Here’s a recap of some … Read more about A Look Back: What’s Changed for Small Businesses in 2025?

What to Know About Holidays and Your Business

Today is Christmas, which is a religious holiday for Christians around the world and a federal holiday in the U.S. When it comes to holidays, the … Read more about What to Know About Holidays and Your Business