Idea of the Day®

December 20, 2025

How State Taxes in 2026 Stack Up

The Tax Foundation’s 2026 State Tax Competitiveness Index ranks states with respect to individual income taxes, corporate taxes, sales and excise taxes, property and wealth taxes, and unemployment insurance taxes. The top 5 states were Wyoming, South Dakota, New Hampshire, Alaska, and Florida. The lowest-ranked 5 localities were New York (at #50), New Jersey, California, District of Columbia, and Connecticut. There is a map to link you to state-specific results. #IdeaoftheDay

Big Ideas for Your Business

Resources For Your Business

December 18, 2025

By Barbara Weltman

There’s only a limited number of days left in 2025, but there is still enough time to complete certain tasks that are required or helpful to end the year properly and get good start for 2026. Take the time to review your company’s business plan for 2026. And don’t overlook the following… Important year-end actions […]

December 17, 2025

Additive manufacturing—3D printing that builds objects layer by layer—is no longer just tools for rapid prototyping. They have matured into powerful production technologies that allow companies to operate with greater agility, efficiency, and precision. As industries face pressure to deliver innovation faster while controlling costs, additive manufacturing offers a practical and increasingly essential solution. It’s […]

December 16, 2025

By Barbara Weltman

If you own a business that isn’t incorporated, your business income likely triggers self-employment (SE) tax to cover Social Security and Medicare taxes. Self-employment tax is imposed on net earnings from self-employment, which is income derived from carrying on a trade or business, minus allowable deductions. A self-employed person pays what amounts to the employee […]

December 11, 2025

By Barbara Weltman

December is National Write a Business Plan Month so it’s an ideal time to think about how you can plan now to scale your business in the coming year. Some actions identified in your plan can be implemented in weeks or months; others take years. Still, having a road map to follow can assist you on […]

December 10, 2025

By John Boyle

As a small business owner, you meticulously manage risk—buying insurance, filing taxes. Yet, one critical risk often flies under the radar: the background music playing in your business. Many owners wrongly assume playing consumer streaming accounts like Spotify or Apple Music is fine. It is not. Let’s be clear: There is no Spotify for Business […]

December 9, 2025

By Barbara Weltman

A retirement plan offers several benefits to you and your staff. As the IRS says, “Retirement plans allow you to invest now for financial security when you and your employees retire. As a bonus, you and your employees get significant tax advantages and other incentives.” Whether you already have a qualified retirement plan for your […]

December 4, 2025

By Barbara Weltman

For 43 days—longer than the biblical flood—the federal government was shut down because it failed to reach a budget or extend the time to do so. The government now has until Friday, January 30, 2026, to pass a budget for its fiscal year 2026 (ending September 30, 2026). The shutdown was a serious blow to […]

December 2, 2025

By Barbara Weltman

While charitable giving may be a year-round activity, this time of the year is especially good for philanthropy. Today is Giving Tuesday, which is one day each year that is dedicated to encouraging generosity worldwide. There are so many worthwhile causes and needy individuals. And there are tax breaks for being generous. Some of the […]

December 1, 2025

If you’re ready to expand your business into new markets across the country, you’ll need more than just ambition. You’ll also have to plan very carefully. Entering a new market isn’t easy. You’ll need to understand how customers from different regions behave. Your operations may need to become more flexible. Every business has a different […]

November 27, 2025

By Barbara Weltman

Did you know that November is National Gratitude Month? Thanksgiving Day—a federal holiday since 1941—is a good time to pause and reflect on what to be grateful for. You probably know that gratitude can be a powerful tool in increasing personal happiness. But did you know that gratitude can also produce important positive results in […]

November 25, 2025

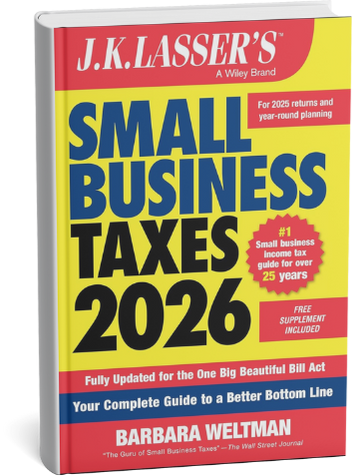

By Barbara Weltman

For nearly 30 years, I’m proud to say my tax book for small businesses has been the go-to guide for owners and tax advisers. The 2026 edition for preparing 2025 returns as well as tax planning for 2026 has been updated to include law changes from the One Big Beautiful Bill Act (OBBBA), as well […]

November 20, 2025

By Barbara Weltman

As your business grows, so too may the scope of benefits offered to employees. Large corporations offer a vast menu of benefits for employees and shoulder much of the cost. But small businesses that are growing can add benefits to their current offering, and in ways that won’t bust the budget. The Business Owner Resource […]

November 18, 2025

By Barbara Weltman

If you have employees, federal and state laws impose various recordkeeping requirements…what the records must contain and how long you must keep them. This recordkeeping chore certainly isn’t the fun part of running a business, but it’s a necessary one. The failure to comply with recordkeeping requirements can result in serious monetary penalties, which is […]

November 13, 2025

By Barbara Weltman

The One Big Beautiful Bill Act (OBBBA) created a personal deduction for tips received by workers in specified industries. The deduction is primarily for employees who receive tips in the normal course of their business activities, such as bartenders and masseurs. But many self-employed individuals receive tips, and they may be eligible for the deduction. […]

November 12, 2025

Running a business is a rewarding career path. Entrepreneurs continually grow as their companies evolve to meet market changes and technological innovations. Learning to incorporate innovative habits into daily routines can also enhance personal growth. By understanding effective mindset strategies, small business owners can see a more rewarding career. Effective mindset strategies include: Practice Recognizing […]

November 11, 2025

By Barbara Weltman

Veterans Day is November 11, a day to remember all of our veterans. It is a federal holiday and is recognized in all 50 states other than Wisconsin. It’s a day when most federal and state offices are closed, and there are parades and celebrations in many localities across the U.S. For me, it’s a […]

November 6, 2025

By Barbara Weltman

When it comes to federal income tax law, there’s an advantage to being a small business. Certain tax breaks only apply to businesses that meet the definition of “small.” There are various definitions for this purpose. Some use gross receipts (what the business takes in), some use the number of employees, and some use business […]

November 5, 2025

By Clara Mendoza

Running a small business today? Then you know payments can make or break your success. Doesn’t matter if you’re managing a corner store or launching the next big online venture – how customers pay you matters way more than most business owners realize. Customers aren’t just hoping for convenient, secure payment options anymore. They’re demanding […]

November 4, 2025

By Barbara Weltman

Maybe my perspective is “old school,” but I think minimum requirements for running any business is to do it ethically, ensure that etiquette is observed, and that all employees are treated equally. Today, the ethics of some people and companies are highly questionable (overcharging customers; sabotage; conflicts of interest), public figures are dropping F bombs, […]

Multimedia

Resources For Your Business

Three E’s for a Great Business: Ethics, Etiquette, Equality

Scaling Your Business with Valuable Local Networking Efforts

What Employers Can Do to Alleviate Employees’ Financial Stress

Smart Offboarding Practices When an Employee Leaves

Barbara’s Books

By Barbara Weltman

THE COMPREHENSIVE HANDBOOK FOR AMERICAN TAXPAYERS LOOKING FOR EVERY LEGAL TAX DEDUCTION AND CREDIT This edition of this popular book has been fully updated to reflect changes from the One Big Beautiful Bill Act, including the no-tax-on tips deduction and overtime pay deduction, expanded child tax credit, and the deduction for interest on new car […]

By Barbara Weltman

COMPREHENSIVE GUIDE TO SMALL BUSINESS TAX WRITE-OFFS AND STRATEGIES FROM A LEADING NAME IN TAX If you own a small business, this comprehensive guide explains in easy-to-understand terms the essentials of business taxes to prepare you to work better with your CPA or other tax adviser or handle tax responsibilities on your own. Whether you’re […]

By Barbara Weltman

Ideas you’ll use everyday! With only so many hours in the day, it’s impossible to stay on top of key developments and opportunities to help you run your business better and smarter. 500+ Big Ideas for Your Small Business gives you quick access to resources and tips you can use every day. Whether you’re a […]

By Barbara Weltman

Your GPS to Get You Where You Want to Go in Your Business Do you enjoy driving and being your own boss with flexible work options? Are you looking for a part-time (or full-time) activity that earns good money? Maybe you’ve already discovered that there are great opportunities for making money with your car. Or, […]

By Barbara Weltman

A Step-By-Step Road Map–with Checklists–to Get You Started Up, Profitable, and Successful Whether you want to start up a part-time home-based business or jump in full throttle and work on it full time, you need a start-up guide. A road map! Home-Based Business Start-Up Guide will help you chart your course to work-from-home success. Written […]

What every self-employed person needs to know about their taxes! If you’re self-employed, chances are the majority of your time is spent finding new customers or clients, servicing existing ones, and handling each and every aspect of your business. Freelancers, independent contractors, gig economy participants, and other individuals working for themselves need to be aware […]

By Barbara Weltman and Harvey Bezozi

Created for Uber and Lyft drivers as their GPS — to help them get where they want to go in their business, safely and securely. Note: This e-Book has been updated with a new title and revised content (shown). Do you enjoy driving and being your own boss with flexible work options? Are you looking […]

By Barbara Weltman

Presenting a recently-launched, updated, paperback edition! Barbara Weltman takes an inspired look in Smooth Failing at the hard lessons learned when things go wrong. Through extensive interviews with entrepreneurs whose ventures failed for a variety of reasons — some stunningly unexpected, some painfully inevitable — Weltman gleans valuable insights about the small mistakes that can lead to large scale catastrophe. Smooth Failing seeks to save readers from similar disaster — while empowering those who are learning from failures and adversity to bounce back stronger and wiser on the often rocky road to success.

By Barbara Weltman and Jerry Silberman

12 surefire ways for your business to survive and thrive! Owning a small business can be a fulfilling and financially rewarding experience, but to be successful, you must know what to do while the business is up and running, and, most importantly, what to do when the business runs into trouble. This book is definitely […]

By Barbara Weltman

As Vicki Raeburn of Dun & Bradstreet notes in the forward, “…the successful creation of credit by small business has a significant effect on one of the most important business drivers, namely cash flow. … [This book has] the information needed to understand and build business credit.”

Testimonials

I just wanted to take a moment to say that I really enjoy reading your content each day. It’s always insightful and appreciated!

– Kristie Walker, Walker Properties, LLC

Thank you for all the helpful tips and ideas I’ve learned from your daily email!

– Sally Howard

You help me become better informed and to feel better connected to other small businesses even if just through knowing we’re all seeing your newsletter and paying attention to the same concerns.

– Sally

Barbara’s newsletter and the information she shares are always useful and topical. Always an excellent newsletter from you, Barbara!

– Bob Benowitz

I love the simplicity of your articles. — Marie

– Marie Porolniczak, CB

Jim Blasingame, Host of The Small Business Advocate Show, and author of the award-winning books, “The 3rd Ingredient,” and “The Age of the Customer” says: “At a time when working from home is becoming the norm, why wouldn’t right now be a perfect time to start a home-based business? If you’re still with me, here’s the next logical question: Why wouldn’t you want to learn how to do that from someone who was home-based before it was cool? Someone who was making being home-based look good before technology made it easy.

Well, that person is my friend, Barbara Weltman, and she’s put all of her experience, wisdom and perspective in a new book, “Home-Based Business Start-up Guide.” It’s a by-the-numbers tutorial on how to launch a successful home-based business.

Let Barbara help you get your home-based business going with her book, and all of the other awesome resources she produces in support of small businesses. She’s the best.” — Jim

– Jim Blasingame, Host of The Small Business Advocate Show

I love your ideas of the day! They have become an instrumental part of my learning!

– Gina Bertoletti

You should sign up for the “Idea of the Day®” by Barbara Weltman. This will give you great tips and help you with your daily business needs. She writes every article with consummate skill.

– Lesley

As a tax attorney and small business specialist, Barbara has a lot of great information to share. Barbara, your blogs contain information that everyone can use! Your newly-expanded ebook, “175+ Big Ideas for Small Business” ebook has lots of great recommendations for small business owners.

– Lisa Rubenfeld

For a small business owner, the information [in your book] is absolutely one of the best I’ve come across! Thanks so much for the break-down of information.

– Michelle Joe

I just wanted to reach out and give you a very big, truly heartfelt “thank you” for all the work that you do to help small business owners grow and succeed.

More specifically, I wanted to offer you some praise for your blog posts and Idea of the Day®. My email inbox gets so very cluttered. And honestly, on most days I will do a wholesale delete of many, many messages. But I literally stop and specifically look for your name and your small business Idea of the Day®. I don’t want to miss it! In fact, I look forward to reading it daily (even on weekends!) because I know I’m going to learn something new that saves me money, time or just adds to my professional knowledge in a way that helps me help others too.

So thank you, thank you, thank you for your efforts!

– Lynnette Khalfani-Cox, The Money Coach

Thank you for finding this important information. Getting your daily email is like getting an MBA in small business.

– J. S. Budnik

“Thank you, Barbara Weltman, for all of your articles and tax advice to small business owners! All the best.”

– Shane Madigan

I follow your blog religiously for the great tips you provide. I love the new look. It makes me smile to see that your blog got an update. Thanks for providing such useful information.

– Lee Drozak

She has been an advocate, public speaker, and resource for small business news since the release of her first book, J.K. Lasser’s Tax Deductions for Small Business, in 1995. Since then she has run her website, her Big Ideas for Small Business® newsletter, and her blog, not to mention written over a dozen books. Ms. Weltman is on this list twice because for many business owners, it is easier to scroll through her Twitter feed for trending topics and news events than search her website. However, if you don’t take a minute to read her newsletters or blog — you’re missing out.

– Meredith Wood, Fundera Ledger

You help me become better informed and to feel better connected to other small businesses even if just through knowing we’re all seeing your newsletter and paying attention to the same concerns.

– Sally

Barbara’s newsletter and the information she shares are always useful and topical. Always an excellent newsletter from you, Barbara!

– Bob Benowitz

I love the simplicity of your articles. — Marie

– Marie Porolniczak, CB

Jim Blasingame, Host of The Small Business Advocate Show, and author of the award-winning books, “The 3rd Ingredient,” and “The Age of the Customer” says: “At a time when working from home is becoming the norm, why wouldn’t right now be a perfect time to start a home-based business? If you’re still with me, here’s the next logical question: Why wouldn’t you want to learn how to do that from someone who was home-based before it was cool? Someone who was making being home-based look good before technology made it easy.

Well, that person is my friend, Barbara Weltman, and she’s put all of her experience, wisdom and perspective in a new book, “Home-Based Business Start-up Guide.” It’s a by-the-numbers tutorial on how to launch a successful home-based business.

Let Barbara help you get your home-based business going with her book, and all of the other awesome resources she produces in support of small businesses. She’s the best.” — Jim

– Jim Blasingame, Host of The Small Business Advocate Show

I love your ideas of the day! They have become an instrumental part of my learning!

– Gina Bertoletti

You should sign up for the “Idea of the Day®” by Barbara Weltman. This will give you great tips and help you with your daily business needs. She writes every article with consummate skill.

– Lesley

As a tax attorney and small business specialist, Barbara has a lot of great information to share. Barbara, your blogs contain information that everyone can use! Your newly-expanded ebook, “175+ Big Ideas for Small Business” ebook has lots of great recommendations for small business owners.

– Lisa Rubenfeld

For a small business owner, the information [in your book] is absolutely one of the best I’ve come across! Thanks so much for the break-down of information.

– Michelle Joe

I just wanted to reach out and give you a very big, truly heartfelt “thank you” for all the work that you do to help small business owners grow and succeed.

More specifically, I wanted to offer you some praise for your blog posts and Idea of the Day®. My email inbox gets so very cluttered. And honestly, on most days I will do a wholesale delete of many, many messages. But I literally stop and specifically look for your name and your small business Idea of the Day®. I don’t want to miss it! In fact, I look forward to reading it daily (even on weekends!) because I know I’m going to learn something new that saves me money, time or just adds to my professional knowledge in a way that helps me help others too.

So thank you, thank you, thank you for your efforts!

– Lynnette Khalfani-Cox, The Money Coach

Thank you for finding this important information. Getting your daily email is like getting an MBA in small business.

– J. S. Budnik

“Thank you, Barbara Weltman, for all of your articles and tax advice to small business owners! All the best.”

– Shane Madigan

I follow your blog religiously for the great tips you provide. I love the new look. It makes me smile to see that your blog got an update. Thanks for providing such useful information.

– Lee Drozak

She has been an advocate, public speaker, and resource for small business news since the release of her first book, J.K. Lasser’s Tax Deductions for Small Business, in 1995. Since then she has run her website, her Big Ideas for Small Business® newsletter, and her blog, not to mention written over a dozen books. Ms. Weltman is on this list twice because for many business owners, it is easier to scroll through her Twitter feed for trending topics and news events than search her website. However, if you don’t take a minute to read her newsletters or blog — you’re missing out.

– Meredith Wood, Fundera Ledger

Barbara Weltman is one smart cookie – I follow her on Twitter, and her content is always interesting and informative.

– An eBay Radio listener – purplejaime1976

It’s BRIEF, concise and timely. Funny, I do a quick scan of my bloated mail box, quickly deleting what I feel is a time waster. But I NEVER delete Idea of the Day® until I’ve first opened it. Both you and Napoleon Hill’s Thought for the day ALWAYS get read. You’re in terrific company. Thanks.

– Don Aronowitz

Read More

Read More